It’s (Almost) That Time of Year: Detail Your Books Before Tax Season

Think of this as your year-end polish — 4 steps to walk into 2026 with clean, confident numbers.

I wasn’t planning to write this post yet.

I’m still learning the auto detailing industry. Studying how shops actually make money, how mobile operators juggle scheduling challenges, who the big players are, why certain models work and others don’t. And honestly, I hate when service providers claim to help an industry they haven’t taken the time to understand.

Great service starts with research. Full stop.

In my own entrepreneurial journey, the best partners were always the ones who showed up prepared. They knew the lingo, the workflow, the pain points, the hidden landmines. They understood the difference between what should happen and what really happens on the ground.

So as I build tools for detailers, pricing systems, financial dashboards, bookkeeping workflows — I’m doing my homework. I’m observing, talking to operators, testing ideas live. Some of this will take time. But I don’t want that to slow down the newsletter momentum we’ve built here.

And that brings me to today’s post.

Tax season is around the corner. The holidays will hit… and then all of a sudden it’s January and everyone’s accountant is begging for documents.

This post is your friendly checklist: 4 things you can start right now to avoid the annual scramble.

Let’s start simple.

The struggle (1/5)

Let’s be honest: tidy books rarely survive the reality of day-to-day operations.

No shame in that. When you’re bouncing between jobs, chasing weather windows, answering customers, fixing equipment, handling marketing, dealing with team issues… bookkeeping is the last thing calling your name.

Even shops with bookkeepers still have homework: mileage logs, receipts, invoices, statements, plus answering questions when your bookkeeper can’t decipher a mystery transaction.

So what happens every January?

A scramble.

Receipts everywhere. Missing invoices. Unmatched payments. Unreconciled accounts. And your accountant quietly questioning their life choices.

This post is designed to prevent that.

Start now and tax season becomes smooth instead of stressful. That’s the deal I’m offering here 😉

Mileage (2/5)

Mileage is one of the easiest deductions for detailers.. and one of the easiest to mess up.

The IRS standard mileage rate for 2025 is $0.70 per business mile. That’s your shortcut. Instead of tracking gas, tires, depreciation, insurance, maintenance, and repairs separately, you multiply your logged miles by the rate.

But here’s the catch: mileage is only deductible when it’s ordinary and necessary for business. Think:

driving between job sites

picking up supplies

driving to a training or trade show (in some cases)

And yes: personal miles are absolutely off-limits.

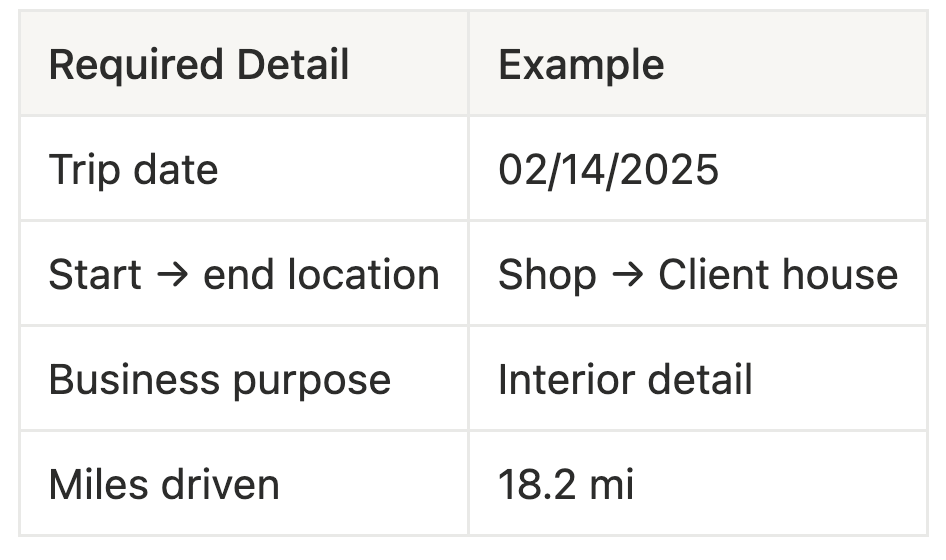

To claim the deduction, you need a complete mileage log. At minimum, these would be the details:

Two more tips that bulletproof your log:

Snap a photo of your odometer on Jan 1 and Dec 31.

Keep logs consistent — daily, weekly, or monthly.

Tools that make this easier:

OrbisX, Urable and similar apps can help with mileage tracking inside job workflows. I still need to try these apps to see how they actually work, but the promise is that they can help at some capacity as well as many other operational and CRM processes.

Apps like Everlance, MileIQ, and TripLog also work… but they can be finicky because iOS and Android sometimes restrict background location tracking.

Your last step (mostly applicable to S-Corps): if you’re using a personal vehicle, mileage is treated as a reimbursement through your business’s accountable plan. That means:

Track your miles.

Calculate the reimbursement.

Transfer money from business → personal on a regular schedule.

That’s what makes the deduction real and defensible.

Goal here: Catch up with your mileage log, make sure it is complete through end of November. This will get you piece of mind when your accountant starts asking you for that pile of documents for your Tax Returns.

Account reconciliations (3/5)

Reconciliation is how you make sure the numbers in your books match the numbers in real life.

For most detailers, the accounts that matter are:

Business checking

Business credit card(s)

Venmo / Cash App / PayPal (if you use them)

Stripe or Square deposits

These accounts capture almost everything, unless you’re still taking cash or checks, which will most likely be at an exception basis.

If you use QuickBooks Online, please hear this: Do not wait until January to reconcile.

You will regret it.

When you fall behind on categorizing transactions and reviewing bank feeds, you open the door to:

Missing transactions

Duplicate transactions

Wrong starting balances

Months of uncleared items

Auto-rules miscategorizing everything under the sun

If you’ve got a bookkeeper, check in: Are you reconciled through November?

If yes, December is easy. If not… now’s the time.

The goal is simple: No missing transactions. No duplicates. No uncategorized leftovers.

Invoices and payment applications (4/5)

Now let’s talk receivables: the money your customers owe you or have already paid.

This is one of those areas that often slips through the cracks, and it makes a bigger difference on your taxable income than most people realize.

Your checklist:

Mark every completed job as paid

Match each payment to the correct invoice

Clear out Undeposited Funds

Clear out Unapplied Cash Payment errors

Follow up on any unpaid October or November jobs

When these items aren’t cleaned up:

Your revenue gets under/overstated

Your tax payables may go up

Your reporting becomes less reliable for tax purposes as well as business analysis

Your accountant has to untangle knots you didn’t mean to tie

If you use OrbisX, Urable, or similar CRM apps, you’re already ahead, but integrations can still break. Watch for:

Customer names mismatching between CRM and QBO (common cause of sync errors)

Duplicate payments showing up

Unapplied payments inflating income

If you don’t clean these up, you will pay tax on money you didn’t actually earn. That’s the opposite of detailing your books.

Contractors, W-9s and 1099s (5/5)

Last reminder for your year-end catch up checklist — and I promise this one is quick.

If you used any contractors this year (a helper on big jobs, someone you paid for marketing, a PDR tech, a mobile guy you brought in for a busy week), you need one simple form from them:

A W-9.

Think of the W-9 as the contractor’s “info sheet.”

It gives you their legal name, address, and tax ID — so when tax season hits, you’re not texting people like, “Hey man, can you send me your info real quick?”

Here’s the basic rule of thumb:

You only send a 1099 if you paid the contractor $600+ by cash, check, Zelle, or bank transfer during the year. If you paid them by credit card or through apps like Stripe, Square, or PayPal Goods & Services, you’re off the hook. The processor handles that reporting.

The W-9 just makes that process smooth instead of stressful.

So here’s what you should do now:

Check in with your accountant on requirements and timeline for 1099s

Go through the list of payments you made during year to identify payments made to contractors

Make sure you have a W-9 for anyone you paid this year

Check who might be close to or over that $600 mark

Add anyone missing to your “needs a W-9” list

That’s it.

Super simple, but incredibly helpful when January rolls around. If you do this now, all you have to do in January is refresh the payment list for December to ensure no new contractor needs to be added to the list to be issued a 1099.

The deadline for 1099s to be filed is January 31, so this one is a quicker turnaround.

You don’t want to be scrambling for information right after the holidays — I've been there, trust me.

A couple minutes now saves a whole lot of pain later.

Recap

If you want a calmer tax season, start now, before the holidays hit and everything turns to chaos.

Here’s your short checklist:

Clean up mileage and make reimbursement transfers

Reconcile all bank, card, and payment accounts through November

Categorize everything and clear out uncategorized transactions

Match all payments to invoices and clean up Undeposited Funds / Unapplied Cash

Collect W-9s from contractors and note who might need a 1099 in January

Follow up on late-paying customers before December ends

These aren’t the only year-end tasks, but they are the big ones that make the rest so much easier.

And if anything here feels confusing or overwhelming, DM me.

We’re not taking clients yet, but I’m always happy to point a detailer in the right direction.

Disclaimer: Everything in this post is meant to give you clarity and direction, not formal accounting or tax advice. Your business, state rules, and tax situation may be different — so run these steps past your accountant to make sure you’re aligned with the right approach for your specific scenario.